Electric vehicle sales are surging in Europe, but there is an exception: Tesla, the largest electric vehicle (EV) automaker, is experiencing a significant decline.

Over the last few months, we have been reporting on Tesla’s concerning decline in sales in Europe.

The most concerning aspect is that Tesla’s decline in sales is occurring amid a surge in electric vehicle (EV) sales in Europe.

The European Automobile Manufacturers’ Association (ACEA) has released its full registration data in Europe for the first quarter of 2025 today – confirming that battery electric car sales surged almost 24%:

In the first quarter of 2025, new battery-electric car sales grew by 23.9%, to 412,997 units, capturing 15.2% of total EU market share. Three of the four largest markets in the EU, accounting for 63% of all battery-electric car registrations, recorded robust gains: Germany (+38.9%), Belgium (+29.9%), and the Netherlands (+7.9%). This contrasted with France, which saw a decline of 6.6%.

Normally, when a market is surging, it benefits the market leader; however, this is not the case here.

ACEA’s data shows that Tesla, the largest electric automaker, has seen its sales fall 37% in the first 3 months of the year:

| Group/Brand | % Share March 2025 | % Share March 2024 | Units March 2025 | Units March 2024 | % Change March 25/24 | % Share Jan-Mar 2025 | % Share Jan-Mar 2024 | Units Jan-Mar 2025 | Units Jan-Mar 2024 | % Change Jan-Mar 25/24 |

| VW Group | 25.2 | 23.5 | 358,210 | 324,897 | 10.3 | 25.9 | 24.4 | 875,875 | 828,384 | 5.7 |

| VW | 10.3 | 9.4 | 146,958 | 130,445 | 12.7 | 10.8 | 9.5 | 364,641 | 323,824 | 12.6 |

| Skoda | 5.4 | 4.8 | 77,287 | 66,764 | 15.8 | 5.7 | 5.5 | 191,732 | 187,205 | 2.4 |

| Audi | 4.6 | 4.7 | 66,062 | 64,964 | 1.7 | 4.8 | 4.8 | 161,446 | 164,255 | -1.7 |

| Cupra | 2.3 | 1.5 | 32,037 | 20,415 | 56.9 | 2.2 | 1.4 | 73,099 | 49,143 | 48.7 |

| Seat | 1.7 | 2.1 | 23,796 | 28,629 | -16.9 | 1.7 | 2.1 | 57,363 | 70,575 | -18.7 |

| Porsche | 0.8 | 0.9 | 11,059 | 12,685 | -12.8 | 0.7 | 0.9 | 25,229 | 31,209 | -19.2 |

| Others | 0.1 | 0.1 | 1,010 | 995 | 1.5 | 0.1 | 0.1 | 2,364 | 2,173 | 8.8 |

| Stellantis | 15.1 | 16.5 | 215,190 | 228,774 | -5.9 | 15.5 | 17.6 | 525,283 | 598,243 | -12.2 |

| Peugeot | 5.5 | 5.0 | 77,803 | 68,772 | 13.1 | 5.6 | 5.4 | 189,254 | 184,256 | 2.7 |

| Citroen | 2.4 | 3.3 | 34,424 | 45,486 | -24.3 | 2.7 | 3.4 | 92,657 | 114,805 | -19.3 |

| Opel/Vauxhall | 3.1 | 3.5 | 44,145 | 48,432 | -8.9 | 2.9 | 3.6 | 97,767 | 122,037 | -19.9 |

| Fiat | 2.2 | 2.7 | 31,128 | 37,566 | -17.1 | 2.3 | 3.0 | 77,704 | 101,332 | -23.3 |

| Jeep | 1.1 | 1.0 | 15,493 | 13,582 | 14.1 | 1.1 | 1.1 | 37,895 | 37,006 | 2.4 |

| Alfa Romeo | 0.5 | 0.4 | 7,306 | 5,039 | 45.0 | 0.5 | 0.4 | 17,095 | 12,594 | 35.7 |

| DS | 0.2 | 0.3 | 3,110 | 4,279 | -27.3 | 0.2 | 0.3 | 8,172 | 11,535 | -29.2 |

| Lancia/Chrysler | 0.1 | 0.4 | 1,319 | 4,890 | -73.0 | 0.1 | 0.4 | 3,527 | 12,988 | -72.8 |

| Others | 0.0 | 0.1 | 462 | 728 | -36.5 | 0.0 | 0.0 | 1,212 | 1,690 | -28.3 |

| Renault Group | 9.8 | 8.9 | 139,645 | 123,629 | 13.0 | 10.2 | 9.2 | 344,519 | 313,179 | 10.0 |

| Renault | 5.8 | 5.1 | 82,020 | 70,175 | 16.9 | 5.6 | 4.7 | 189,138 | 160,716 | 17.7 |

| Dacia | 4.0 | 3.8 | 56,841 | 52,988 | 7.3 | 4.5 | 4.5 | 153,382 | 151,486 | 1.3 |

| Alpine | 0.1 | 0.0 | 784 | 466 | 68.2 | 0.1 | 0.0 | 1,999 | 977 | 104.6 |

| Hyundai Group | 7.8 | 8.1 | 110,714 | 112,571 | -1.6 | 7.9 | 8.2 | 267,234 | 278,387 | -4.0 |

| Kia | 4.3 | 4.3 | 60,586 | 59,335 | 2.1 | 4.1 | 4.2 | 138,432 | 143,151 | -3.3 |

| Hyundai | 3.5 | 3.8 | 50,128 | 53,236 | -5.8 | 3.8 | 4.0 | 128,802 | 135,236 | -4.8 |

| Toyota Group | 6.9 | 7.4 | 98,484 | 101,949 | -3.4 | 7.4 | 7.7 | 248,663 | 260,178 | -4.4 |

| Toyota | 6.4 | 6.9 | 90,507 | 94,884 | -4.6 | 6.7 | 7.2 | 227,486 | 243,124 | -6.4 |

| Lexus | 0.6 | 0.5 | 7,977 | 7,065 | 12.9 | 0.6 | 0.5 | 21,177 | 17,054 | 24.2 |

| BMW Group | 6.8 | 7.0 | 96,532 | 97,221 | -0.7 | 7.0 | 6.9 | 236,401 | 235,269 | 0.5 |

| BMW | 5.7 | 5.8 | 80,481 | 80,647 | -0.2 | 5.8 | 5.8 | 195,913 | 196,406 | -0.3 |

| Mini | 1.1 | 1.2 | 16,051 | 16,574 | -3.2 | 1.2 | 1.1 | 40,488 | 38,863 | 4.2 |

| Mercedes-Benz | 5.3 | 5.9 | 75,473 | 82,291 | -8.3 | 4.9 | 5.2 | 165,518 | 174,994 | -5.4 |

| Mercedes | 5.2 | 5.7 | 74,484 | 79,488 | -6.3 | 4.8 | 4.9 | 162,595 | 167,608 | -3.0 |

| Smart | 0.1 | 0.2 | 989 | 2,803 | -64.7 | 0.1 | 0.2 | 2,923 | 7,386 | -60.4 |

| Ford | 3.7 | 3.5 | 52,217 | 48,203 | 8.3 | 3.4 | 3.4 | 114,678 | 116,905 | -1.9 |

| Nissan | 3.6 | 3.7 | 50,839 | 51,722 | -1.7 | 3.0 | 3.0 | 100,063 | 103,014 | -2.9 |

| Volvo Cars | 2.5 | 2.8 | 35,752 | 38,593 | -7.4 | 2.5 | 2.7 | 83,092 | 92,206 | -9.9 |

| SAIC Motor | 2.7 | 1.9 | 38,930 | 26,189 | 48.6 | 2.3 | 1.7 | 78,505 | 58,800 | 33.5 |

| Tesla | 2.0 | 2.9 | 28,502 | 39,684 | –28.2 | 1.6 | 2.5 | 54,020 | 86,027 | -37.2 |

| Suzuki | 1.4 | 1.8 | 19,769 | 24,419 | -19.0 | 1.5 | 1.8 | 49,631 | 58,815 | -15.6 |

| Mazda | 1.5 | 1.5 | 21,323 | 20,235 | 5.4 | 1.3 | 1.3 | 43,918 | 45,152 | -2.7 |

| Jaguar Land Rover Group | 1.6 | 1.8 | 22,550 | 24,710 | -8.7 | 1.2 | 1.3 | 41,430 | 44,995 | -7.9 |

| Land Rover | 1.5 | 1.4 | 21,422 | 19,200 | 11.6 | 1.1 | 1.1 | 38,824 | 36,314 | 6.9 |

| Jaguar | 0.1 | 0.4 | 1,128 | 5,510 | -79.5 | 0.1 | 0.3 | 2,606 | 8,681 | -70.0 |

| Honda | 0.8 | 0.9 | 10,746 | 12,753 | -15.7 | 0.6 | 0.7 | 21,075 | 24,130 | -12.7 |

| Mitsubishi | 0.4 | 0.8 | 5,596 | 11,586 | -51.7 | 0.4 | 0.7 | 12,536 | 22,334 | -43.9 |

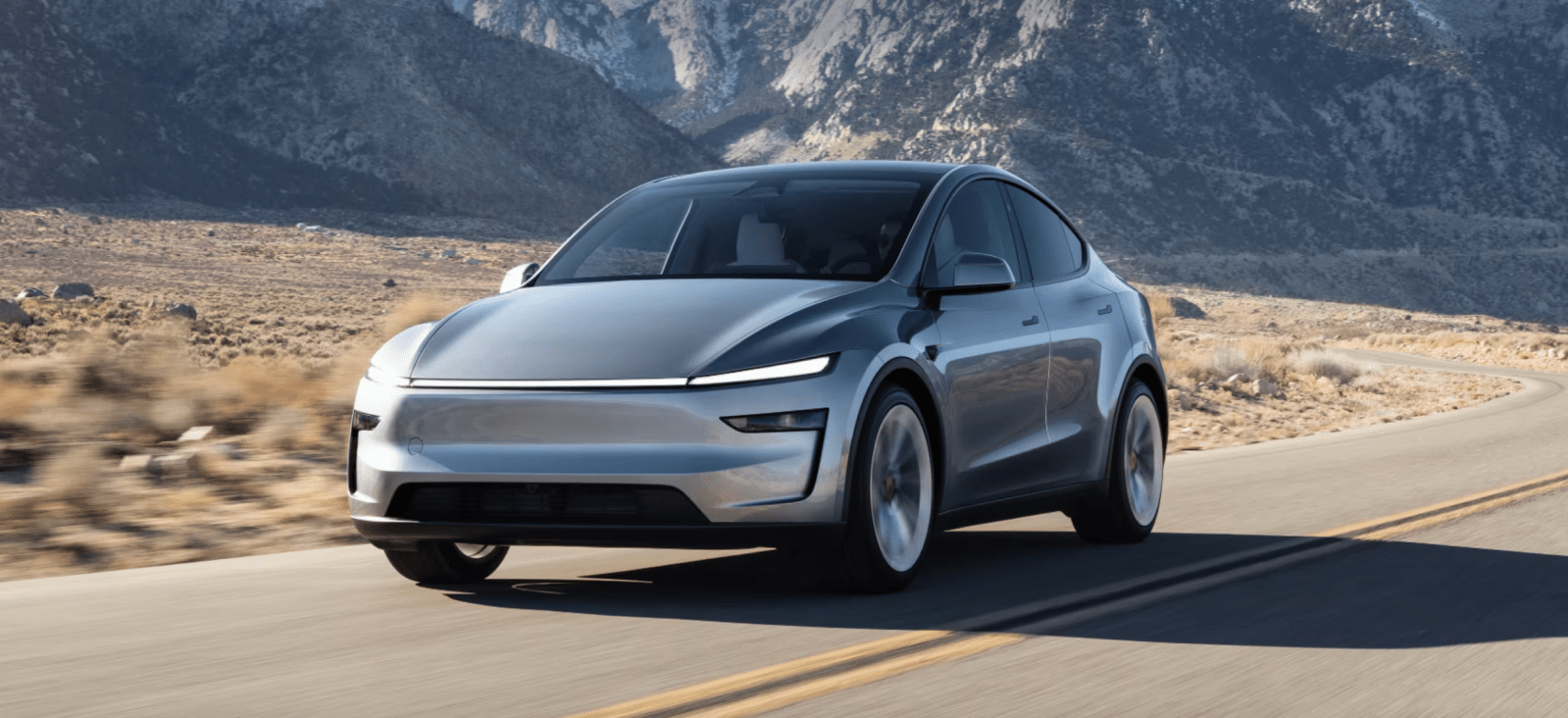

Some Tesla fans are trying to argue that the only reason this is happening is due to the Model Y changeover last quarter affecting supply, but there is evidence to the contrary.

The Model Y changeover has indeed reduced supply during the first quarter, but the vehicle arrived by March, and Tesla’s sales were still down more than 28% in March.

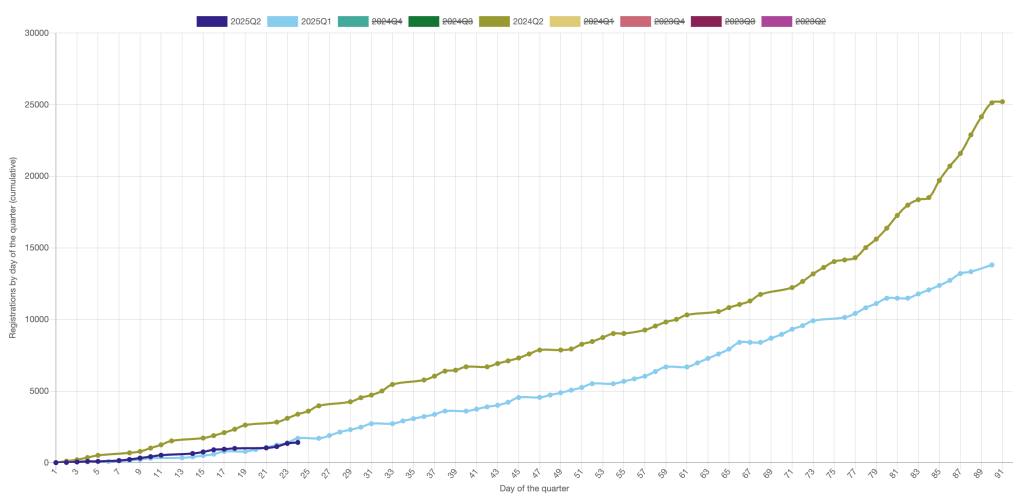

Tesla said that it’s now back to full capacity, and yet, the current quarter is tracking behind the first quarter in the European countries that report daily registrations:

Top comment by Gussy23

It seems fans and financial analysts are brushing this off. Not sure why. Musk offered no material guidance on how the company plans on turning things around on the global stage. The EU numbers should be concerning because his DOGE antics are limited to the US. His lack of attention to Tesla while he runs around Washington is not on trial in Europe. Fair to say Europeans likely have longer memories than we do here in the states.

This points to a severe demand issue that extends far beyond the Model Y changeover, especially considering that the broader electric vehicle (EV) market is currently surging.

Electrek’s Take

It bothers me that Tesla fans are downplaying this. If Tesla can’t reverse this trend in the coming months, it will find itself almost entirely squeezed out of the European market.

That’s happening while Tesla is offering a year of free Supercharging and 0% interest on the new Model Y in Europe.

I believe Tesla should take this seriously. Otherwise, it could find itself selling fewer than 200,000 vehicles a year in Europe starting next year.

FTC: We use income earning auto affiliate links. More.

Comments